1. Early Life, Education & Principles

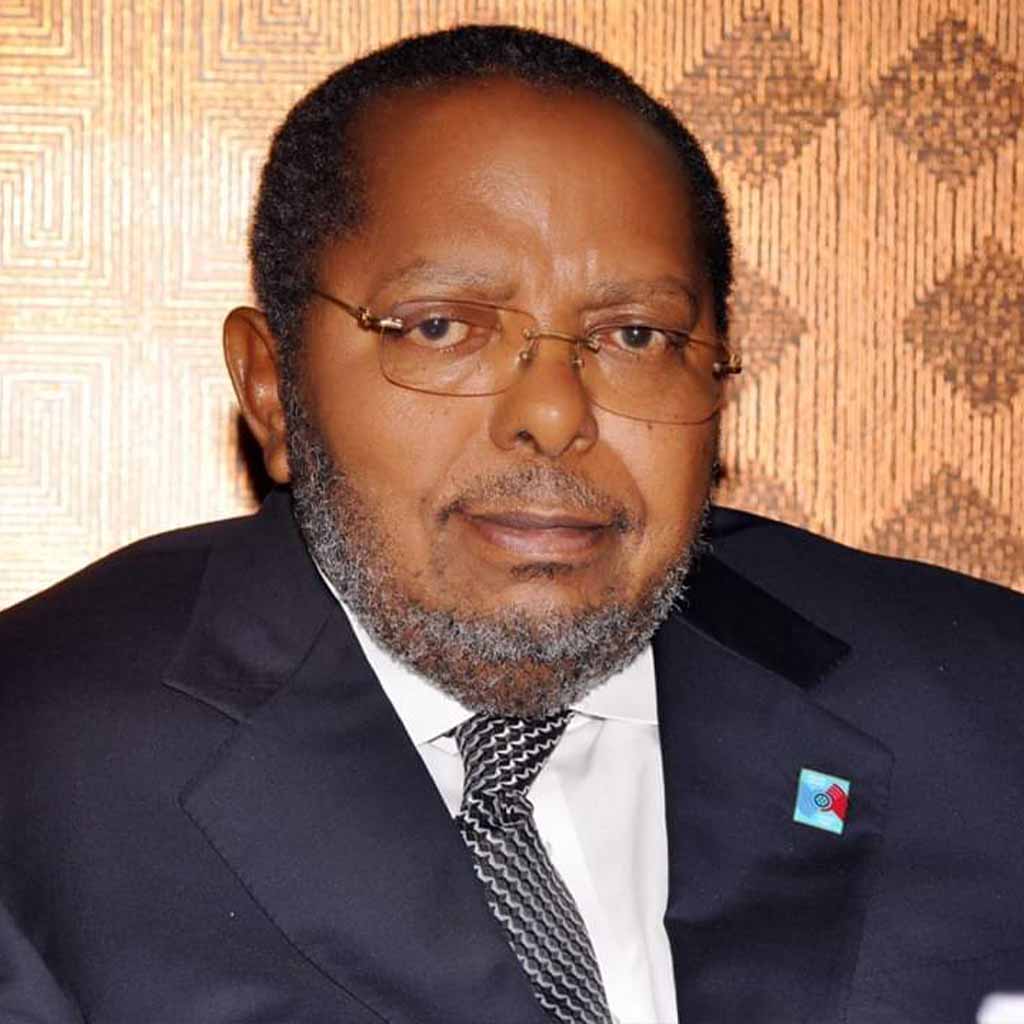

Emmanuel Tumusiime‑Mutebile was born on 27 January 1949 in Kabale District. He attended Kigezi College Butobere before completing his A-Levels at Makerere College School, where he was also elected Students’ Guild president.Wikipedia

In 1970, he entered Makerere University, but political pressures during Idi Amin’s regime—particularly a critical speech he made—forced him into exile in 1972. He continued his studies at Durham University (Bachelor’s in Economics & Politics), followed by postgraduate work at Balliol College, Oxford, before lecturing at the University of Dar es Salaam while pursuing his PhD in Economics.tmf.or.ugWikipedia

2. From Public Service to Economic Stewardship

Mutebile took on key government roles from 1979 to 1984—serving as Deputy Principal Secretary at State House, Undersecretary in the Ministry of Planning, and later Chief Economist.tmf.or.ugWikipedia

In 1992, he became Permanent Secretary to the merged Ministry of Finance, Planning & Economic Development, a consolidation he had ardently advocated for under Finance Minister Gerald Ssendaula.tmf.or.ugWikipedia

3. Longest‑Serving Central Banker in Africa

Appointed Governor and Chairman of the Bank of Uganda (BoU) in January 2001, Mutebile went on to become Uganda’s longest-serving BoU chief, and at the time of his passing, the longest-serving central bank governor in Africa.tmf.or.ugWikipedia

Through multiple reappointments in 2006, 2011, and 2016, he presided over two decades of macroeconomic reform and growth before passing on 23 January 2022 in Nairobi at age 72.Wikipedia+1

4. Reformist Architect of Economic Recovery

Mutebile is best known for spearheading Uganda’s Economic Reform Program—stabilizing governance, combating inflation, and modernizing fiscal policy. He was instrumental in enabling BoU to pursue monetary independence and prudential regulation during the tumultuous 1970s–80s era.tmf.or.ugBank of Uganda

His influence extended to mobile money adoption too—shaping regulatory frameworks by insisting that virtual funds be escrowed with licensed institutions and overseen by BoU to safeguard consumers.Bank for International Settlements

5. Scholar, Advisor & Academic Influencer

From 2006, Mutebile served as a Visiting Professor of Economics at Makerere University, where his legacy endures through the Prof. Emmanuel Tumusiime-Mutebile Chair in Monetary Policy, Banking and Finance and the Tumusiime-Mutebile Centre of Excellence.tmf.or.ugBank of Uganda

He also served as Chancellor of the International University of East Africa and received an Honorary PhD from Nkumba University in recognition of his contribution to Uganda’s financial sector.tmf.or.ugWikipedia

6. Vision on Central Banking, Inclusion & Stability

Mutebile championed central bank independence, advocating for BoU’s autonomy in monetary decisions as prescribed by Uganda’s Constitution.Bank for International Settlements

He also foresaw challenges and opportunities in integrating technology into finance—recognizing the need to balance financial inclusion (via agent networks and mobile money) with cost-efficiency and systemic stability.Bank for International Settlements

In 2018, during a speech at the East African Banking School, he foresaw disruptive trends reshaping banking and urged the regulator to adapt swiftly.Bank for International Settlements

7. Enduring Legacy & Visionary Governance

- Economic Stewardship: Guided Uganda’s recovery and financial prudence for over two decades.

- Institutional Strengthening: Wrote new rules for mobile payments, banking supervision, and institutional accountability.

- Academic Beacon: Mentored the next generation through university roles and endowed professorships.

- Structural Reforms: Seems central banking matured institutionally under his watch.

Summary

Emmanuel Tumusiime‑Mutebile’s life and leadership chart the rise of modern Uganda’s economy. A visionary reformer, he brought discipline to public finance, independence to central banking, and foresight to digital financial inclusion.

Leave a Reply