Uganda’s Historical Relationship with East African Monetary Integration Colonial Legacy and Early Experiments:Uganda, along with Kenya and Tanzania (then Tanganyika),...

Cross-Border Lending Between Uganda and Kenya

1. The Context: East African Financial Integration East Africa’s economic integration continues to deepen across trade, infrastructure, and financial markets....

COVID-19’s Impact on Uganda’s Banking Sector

1. Pre‑Pandemic Landscape: A Strong Foundation Before COVID‑19, Uganda’s banking sector demonstrated steady growth and resilience: This solid footing provided...

The Launch of Mobile Money in Uganda

1. Setting the Stage: Uganda Pre‑2009 Before 2009, financial inclusion in Uganda was low. Only around 16% of adults had...

Uganda’s Contribution to Africa’s Microfinance Movement

1. Historical Foundations of Microfinance in Uganda Uganda’s microfinance ecosystem traces back to early collective financial models: 2. Birth of...

Regional Banking Partnerships

1. Building Bridges: Ugandan Banks in Regional Consortiums Uganda’s banking landscape has become increasingly interwoven with regional networks. Institutions like...

Uganda’s Journey to Financial Inclusion

1. A Vision Emerges: National Strategy for Inclusion (2017–2022) 2017 — Uganda launched its National Financial Inclusion Strategy I (NFIS...

How the 2008 Global Financial Crisis Affected Uganda

1. A Curtain-Raiser: The Global Shockwaves of 2008 The financial crisis that erupted in the United States in 2007 quickly...

African Development Bank Projects in Uganda

1. Energy: Powering Uganda’s Regional Connectivity Uganda–South Sudan Electricity Interconnection Project In December 2024, the African Development Fund (ADF)—the concessional...

The Role of Banking in Uganda’s Agricultural Sector

Manufacturing is a cornerstone of Uganda’s economic growth. It contributes significantly to employment, GDP, and exports. According to the Uganda...

Uganda’s Banking Crisis of the 1990s

1. The Turbulent 1990s: Context and Collapse The 1990s marked a period of grave instability for Uganda’s banking sector. Several...

Young Entrepreneurs Shaping Uganda’s Financial Future

1. Uganda’s Emerging Fintech Talent Landscape Uganda’s startup scene is vibrant, with rising ground-breaking fintech innovators redefining inclusive financial services....

Interview – Insights from a Ugandan Bank CEO

Meet the Leader For this in-depth feature, we highlight the perspective of Charles Mudiwa, CEO of dfcu Bank, whose transformative...

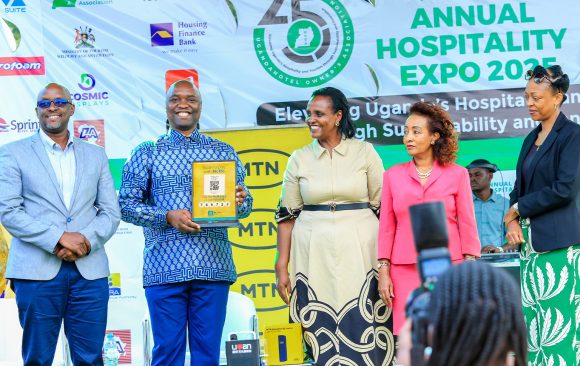

Banking for Tourism – Financing Uganda’s Hospitality Sector

Tourism is one of Uganda’s most vibrant economic sectors, often referred to as the “Pearl of Africa’s golden goose.” The...

Bank Loans for Manufacturing in Uganda – Opportunities

Manufacturing is a cornerstone of Uganda’s economic growth. It contributes significantly to employment, GDP, and exports. According to the Uganda...

Uganda’s Top Female Leaders in Banking

1. Overview: Women Rise in Uganda’s Banking Sector Ugandan banking, historically male-dominated, is seeing impactful leadership from women across executive...

Profile – Emmanuel Tumusiime-Mutebile, Former BoU Governor

1. Early Life, Education & Principles Emmanuel Tumusiime‑Mutebile was born on 27 January 1949 in Kabale District. He attended Kigezi...

Financial Support for Education in Uganda – Loans & Scholarships

Education is widely recognized as one of the most powerful drivers of socio-economic development. In Uganda, education equips the youth...

Uganda’s Banking Role in Infrastructure Development

Infrastructure development is the backbone of any country’s economic growth. In Uganda, projects such as roads, bridges, power plants, oil...

How to Choose the Right Bank Account in Uganda

For many Ugandans, opening a bank account is the first step toward financial independence and stability. Whether you are a...

Pioneers of Uganda’s Banking Industry

1. Historical Origins: From Independence to a Modern Banking Landscape At independence in 1962, Uganda inherited colonial-era financial institutions—chiefly Barclays...

Case Study – dfcu Bank’s Role in SME Financing

1. Overview: DFCU’s Market Position and Influence Founded in 1964 as the Development Finance Company of Uganda, dfcu Bank evolved...

Case Study – Digital Transformation at Stanbic Bank Uganda

1. A Legacy Institution with a Modern Vision Stanbic Bank Uganda, founded in 1906 (first as the National Bank of...

Case Study – The Transformation of PostBank Uganda

1. Origins: From Postal Savings to Financial Institution Founded in 1926 as part of the Post Office’s savings arm, PostBank...

Understanding Interest Rates in Ugandan Banking

When most Ugandans walk into a bank—whether in Kampala, Hoima, Masindi, or Fort Portal—the first question they ask when applying...

Case Study – How Equity Bank Expanded Across Uganda

1. Strategic Entry: Acquisition of Uganda Microfinance (2008–2009) Equity Bank’s journey in Uganda began with the acquisition of Uganda Microfinance...

Avoiding Hidden Banking Fees in Uganda

Banking in Uganda has transformed rapidly over the last decade. With the rise of digital transactions, mobile banking, agency banking,...

Case Study – The Success of Centenary Bank in Uganda

Introduction: From Microfinance Trust to Uganda’s Banking Leader Centenary Bank began in 1983 as the Centenary Rural Development Trust (CRDT)—a...

How to Build a Good Credit Score in Uganda

In today’s financial world, a good credit score is one of the most valuable assets an individual or business can...

Retirement Planning in Uganda

1. Why Planning for Retirement Matters in Uganda With life expectancy rising and formal social security systems reaching only a...

Banking for Students in Uganda

1. Why Student-Focused Banking Matters For students, managing money responsibly while balancing tuition, living costs, and academics is vital. Student-friendly...

Safe Online Banking Practices for Ugandan Customers

The Ugandan banking industry has undergone a significant transformation over the last decade. From long queues in traditional branches to...

Fraud and Scams in Uganda’s Banking Sector

Why reporting matters (and why timing is everything) Fraudsters move quickly: they test small transactions, escalate limits, and transfer funds...

Financial Literacy in Uganda

1. Why Financial Literacy Is Essential Financial literacy empowers individuals to understand and manage money wisely—covering areas like budgeting, saving,...

Understanding Bank Fees in Uganda

Banking in Uganda has never been more accessible, thanks to mobile money, digital banking, and expanded branch networks. However, many...

How to Open a Bank Account in Uganda

1. Overview: Why Open a Bank Account? Bank accounts in Uganda offer a gateway to secure money management, access to...

Contactless Payments in Uganda

Contactless payments — once a futuristic concept — are now a growing reality in Uganda’s evolving banking ecosystem. With the...

Cybersecurity in Uganda’s Financial Industry

As Uganda’s financial sector rapidly digitizes, cybersecurity has become one of its most urgent challenges. Banks, fintech startups, SACCOs, and...

Artificial Intelligence in Ugandan Banking

Artificial Intelligence (AI) is rapidly redefining global banking, and Uganda is no exception. Although the adoption curve is still developing,...

Blockchain and Cryptocurrency in Uganda

Blockchain and cryptocurrency technologies are gradually taking root in Uganda, offering new possibilities for transparency, cross-border payments, and digital innovation...

Fintech Startups in Uganda

Exploring the innovators reshaping finance in East Africa’s rising tech hub Uganda’s fintech sector has grown from a niche corner...

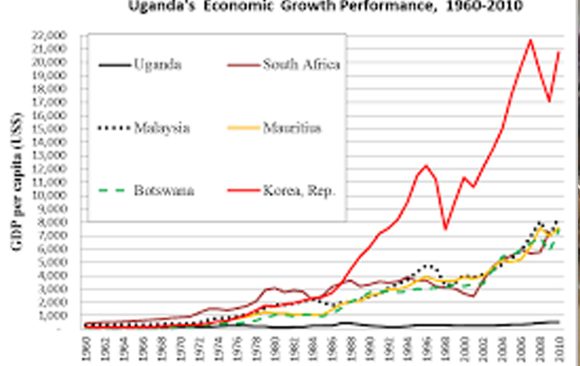

Impact of Global Economic Trends on Uganda’s Banking Sector

Introduction Global economic trends—from oil prices and commodity swings to global interest shifts and climate events—have direct implications for Uganda’s...

Cross-Border Banking in East Africa

Introduction Cross-border banking is vital to economic integration and business fluidity in East Africa. Ugandan banks—alongside regional and pan-African institutions—play...

Uganda’s Balance of Payments

Introduction Understanding Uganda’s Balance of Payments (BoP) offers critical insight into the country’s economic health, external vulnerabilities, and global trade...

Remittances to Uganda

Introduction Remittances—funds sent by Ugandans living abroad to friends and family—are a vital economic lifeline. With over US $1.4 billion flowing into...

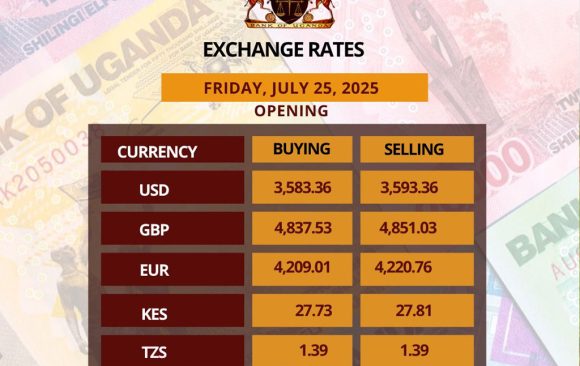

Uganda’s Foreign Exchange Market

Uganda’s foreign exchange (forex) market plays a pivotal role in its economic stability. It reflects the balance of global trade,...

Agricultural Insurance in Uganda

Agriculture is the backbone of Uganda’s economy, employing over 70% of the population. Yet the sector is highly vulnerable to...

Motor Vehicle Insurance in Uganda

Motor vehicle insurance is a legal and financial necessity for every car owner in Uganda. Whether you’re a private driver,...

Life Insurance in Uganda

Life insurance is one of the most important financial tools available for long-term security, yet it remains underutilized in Uganda....

Health Insurance in Uganda

Access to quality healthcare in Uganda is often limited by high out-of-pocket expenses, especially in emergencies. Health insurance is a...

Overview of Uganda’s Insurance Industry

The insurance sector in Uganda has undergone significant growth and transformation over the past decade, emerging as a critical pillar...

Foreign Direct Investment in Uganda

Foreign Direct Investment (FDI) is pivotal for Uganda’s economic transformation. It fuels job creation, infrastructure development, and technological advancement. In...

How to Start Investing in Uganda

Investing can be a powerful path to building legacy, but getting started wisely matters. This guide will walk beginners through...

Government Bonds in Uganda

Government bonds serve as one of the most secure and accessible investment vehicles in Uganda. Issued by the Government through...

Top Performing Stocks in Uganda

Uganda’s stock market has gained renewed momentum in 2025, driven by robust corporate performance, strong dividend payouts, and growing investor...

Uganda Securities Exchange

The Uganda Securities Exchange (USE) serves as the country’s key capital markets hub—enabling individuals and institutions to invest in publicly...

Islamic Banking in Uganda

Uganda’s financial sector has undergone remarkable transformation in the last two decades, with digital banking, mobile money, and cross-border remittance...

Green Banking Initiatives in Uganda

The financial sector has long been viewed as a driver of economic growth, but in recent years, it has also...

Diaspora Banking Services for Ugandans Abroad

Uganda has one of the most vibrant diaspora communities in Africa, with millions of Ugandans living, working, and studying abroad....

Youth Banking in Uganda

Banking has traditionally been seen as an activity reserved for working adults, businesses, and corporate clients. However, over the last...

The Impact of Diaspora Remittances on Uganda’s Economy

Diaspora remittances have become a critical component of Uganda’s economy, representing a significant source of foreign exchange, household income, and...

Bank Partnerships for International Transfers to Uganda

In an increasingly globalized economy, international transfers to Uganda have become a critical component of financial operations for both individuals...

How to Open a Ugandan Bank Account from Abroad

As globalization continues to reshape the world economy, Ugandans living abroad are becoming increasingly connected to their families, investments, and...

Cost of Sending Money to Uganda

Remittances are the financial lifeline of many Ugandan households. Every year, millions of Ugandans living abroad send money back home...

The Future of Mobile Banking in Uganda

Banking is changing faster in Africa than anywhere else in the world. In countries like Uganda, where mobile money adoption...

How COVID-19 Changed Banking in Uganda

The COVID‑19 pandemic triggered a seismic shift in Uganda’s banking sector—accelerating digital transformation, reshaping customer experience, and testing institutional resilience....

Uganda’s Role in East African Banking Integration

Uganda is not only a key player within the East African Community (EAC); it is a foundational hub for regional...

Banking Fraud in Uganda

As banking and financial services in Uganda grow more digital, fraud schemes have become increasingly sophisticated. From mobile money scams...

The Impact of Mobile Banking Apps in Uganda

Mobile banking apps are steadily redefining how Ugandans access and manage their financial lives. From enabling remote account opening to...

Uganda’s Fintech Revolution

Uganda’s financial services landscape is undergoing a profound transformation. Fintech startups are rapidly reshaping the way financial services are delivered—from...

Uganda’s Interest Rate Trends Since 1962

Interest rates serve as the heartbeat of an economy—reflecting policy responses, inflation dynamics, and economic shocks. Uganda’s interest rate journey,...

Anti-Money Laundering in Uganda’s Financial Sector

A Key Line of Defense for the Integrity of Financial Services Money laundering and the financing of terrorism (ML/TF) pose...

Uganda Banking Laws

Navigating financial services can feel complex—but you don’t need a law degree to understand your rights and protections as a...

Financial Inclusion Policies in Uganda

Ensuring that all Ugandans—regardless of gender, geography, or economic status—have access to quality financial services is central to economic empowerment...

Cryptocurrency Adoption in Uganda

Cryptocurrency, once seen as a fringe innovation, is now reshaping the global financial landscape. From Bitcoin to stablecoins and central...

AI and Automation in Ugandan Banking

Banking worldwide is undergoing a seismic shift, fueled by artificial intelligence (AI) and automation technologies that are redefining customer experience,...

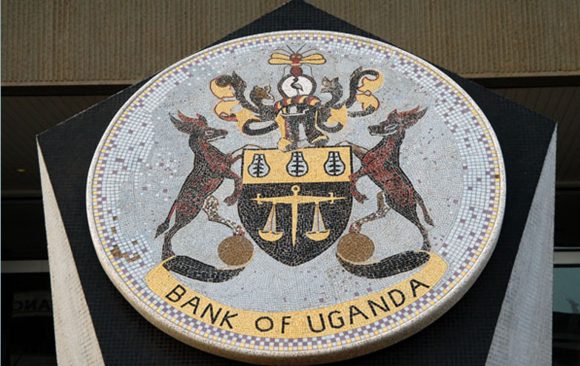

Uganda’s Central Bank Role in Economic Stability

The Bank of Uganda (BoU) plays a pivotal role in maintaining macroeconomic stability, safeguarding the financial system, and fostering economic...

Digital-Only Banks in Uganda

The financial sector in Uganda has undergone a dramatic transformation over the last two decades. Once dominated by traditional banks...

Glossary of Banking Terms

Banking and finance are at the heart of Uganda’s economic growth. Whether you’re opening your first savings account, applying for...

How Uganda Regulates Its Banks

The banking sector is one of the pillars of any economy, providing financial intermediation, savings, investments, and access to credit....

Financial Literacy Programs in Uganda

Why Financial Literacy Matters in Uganda Financial literacy is more than just knowing how to save money—it’s about building the...

Mobile Money Services in Uganda

Over the past 15 years, mobile money has revolutionized financial inclusion in Uganda. What began as a simple method for...

Personal Loans in Uganda

In Uganda’s fast-evolving financial environment, personal loans have emerged as one of the most accessible forms of credit for individuals...

Mortgages in Uganda

A Comprehensive Guide to Home Financing Options and Requirements Homeownership remains one of the most significant milestones for individuals and...

Business Loans in Uganda

Access to affordable business financing is a vital component of Uganda’s private sector development. Whether you’re starting a small retail...

Savings Accounts in Uganda

In Uganda, savings accounts remain a cornerstone for both individuals and businesses striving to grow and secure their finances. With...

Your Rights as a Bank Customer in Uganda

Banking is more than just saving or borrowing money. It is a relationship based on trust, accountability, and fairness. In...

Rural Banking in Uganda

More than 70% of Uganda’s population lives in rural areas, with many depending on agriculture, small-scale trade, and informal employment....

Foreign Banks in Uganda

Uganda’s financial sector is home to a mix of domestic and international players — with foreign-owned banks occupying a significant...

The Growth of Digital Banking in Uganda

Over the last decade, digital banking has redefined the way Ugandans access, use, and interact with financial services. Once dominated...

Role of Microfinance Institutions in Uganda’s Economy

Empowering Small Enterprises, Farmers, and Financially Excluded Populations Microfinance Institutions (MFIs) have become vital players in Uganda’s financial system, filling...

Top Commercial Banks in Uganda

An Updated Guide to Market Leaders, Growth, and Customer Satisfaction As of 2025, Uganda’s banking sector continues to evolve, shaped...

The Rise of Commercial Banks in Uganda Post-2000

Introduction Following sweeping financial reforms in the 1990s, Uganda’s banking landscape entered a dynamic period of expansion, diversification, and modernization....

Uganda’s Banking Reforms in the 1990s

Introduction The 1990s marked a pivotal era in Uganda’s financial history. Following periods of instability and underperformance, the government, with...

Evolution of Ugandan Currency

1. Pre-Independence Legacy: East African Shilling Prior to independence, Uganda used the East African Shilling, managed by the East African...

The Birth of the Bank of Uganda – 1966 Origins

Introduction In the wake of independence, Uganda sought to assert control over its monetary system and central banking. This ambition...

History of Banking in Uganda Since Independence (1962–Today)

Introduction Uganda’s banking sector has experienced profound transformations since gaining independence in 1962. Beginning with a system dominated by foreign...

International Transfers (SWIFT/BIC Code)

Please use the Head Office code (BFBKUGHO) for all international wire transfers unless instructed otherwise by your branch.