As banking and financial services in Uganda grow more digital, fraud schemes have become increasingly sophisticated. From mobile money scams and digital lending traps to impersonation and cheque fraud, fraudsters are creative—and persistent. Here’s a detailed guide to current schemes and actionable strategies to keep your money secure. 1. Common Fraud Schemes in Uganda Mobile...

Category: Bunyoro Finance Bank

The Impact of Mobile Banking Apps in Uganda

Mobile banking apps are steadily redefining how Ugandans access and manage their financial lives. From enabling remote account opening to offering loans and real-time alerts, these apps are enhancing convenience, improving security, and fostering active customer engagement—especially for those in underserved communities. 1. Driving Convenience and Access 2. Financial Inclusion and Everyday Impact 3. Security...

Uganda’s Fintech Revolution

Uganda’s financial services landscape is undergoing a profound transformation. Fintech startups are rapidly reshaping the way financial services are delivered—from mobile money to digital loans and savings products. This revolution goes beyond convenience; it’s fueling inclusion, driving innovation, and setting the stage for the future of banking. 1. Fintech’s Rising Influence and Economic Role 2....

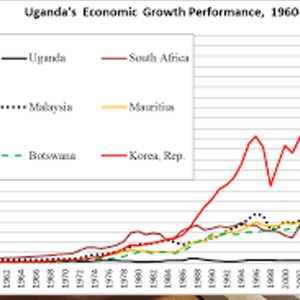

Uganda’s Interest Rate Trends Since 1962

Interest rates serve as the heartbeat of an economy—reflecting policy responses, inflation dynamics, and economic shocks. Uganda’s interest rate journey, spanning from the early post-independence era to today, mirrors the nation’s economic highs, policy shifts, and resilience. This article traces that journey, offering insights for anyone seeking to understand the implications for borrowing, saving, and...

Anti-Money Laundering in Uganda’s Financial Sector

A Key Line of Defense for the Integrity of Financial Services Money laundering and the financing of terrorism (ML/TF) pose serious threats to Uganda’s economy, governance, and global reputation. To combat these risks, the country has built a multi-layered legal and regulatory framework backed by strong institutions. This article unpacks how Uganda safeguards its financial...

Uganda Banking Laws

Navigating financial services can feel complex—but you don’t need a law degree to understand your rights and protections as a customer. Uganda’s banking sector is governed by clear laws and guidelines to promote fairness, transparency, and safety. This guide simplifies the key regulations and what they mean for you. 1. What Regulates Banking in Uganda?...

Financial Inclusion Policies in Uganda

Ensuring that all Ugandans—regardless of gender, geography, or economic status—have access to quality financial services is central to economic empowerment and inclusive growth. Over the past decade, Uganda has implemented comprehensive strategies to bridge financial gaps. This article reviews key policies, achievements, and persistent challenges as the nation moves forward. 1. The National Financial Inclusion...

Cryptocurrency Adoption in Uganda

Cryptocurrency, once seen as a fringe innovation, is now reshaping the global financial landscape. From Bitcoin to stablecoins and central bank digital currencies (CBDCs), digital assets are redefining how people save, invest, and transfer money. Africa has emerged as a hotspot for crypto adoption, with Nigeria, Kenya, and South Africa leading the way. Uganda, with...

AI and Automation in Ugandan Banking

Banking worldwide is undergoing a seismic shift, fueled by artificial intelligence (AI) and automation technologies that are redefining customer experience, operations, and financial inclusion. From mobile apps that process real-time payments to AI-driven chatbots offering 24/7 support, banks are no longer just financial institutions but digital service providers. In Africa—and particularly in Uganda—banks are embracing...

Uganda’s Central Bank Role in Economic Stability

The Bank of Uganda (BoU) plays a pivotal role in maintaining macroeconomic stability, safeguarding the financial system, and fostering economic growth. Established in 1966 and governed by the Bank of Uganda Act (Cap 51, 2000) and the Constitution, it carries a dual mandate: maintaining price stability and ensuring overall financial system resilience. 1. Legal Mandate...