1. Pre‑Pandemic Landscape: A Strong Foundation

Before COVID‑19, Uganda’s banking sector demonstrated steady growth and resilience:

- From 1999 to 2020, the number of commercial banks rose, and total assets surged from UGX 1.35 trillion to UGX 38.3 trillion MDPI.

- Non‑performing loans (NPLs) declined markedly, from 26 % in 1999 to just 5.3 % by 2020 MDPI.

- By 2021, 66 % of adults owned an account or used mobile money, outperforming the regional average IMF eLibrary.

This solid footing provided a buffer as the pandemic struck.2. Shockwaves from COVID‑19: Lending, Liquidity, and Profitability

2.1 Lending Pressures

The economic slowdown and restrictions severely impacted borrowers’ ability to service loans. By mid‑2020, NPLs had grown from 3.4 % in 2018 to 4.9 % in 2019, and 5.3 % in 2020 MDPI.

2.2 Profit Erosion

Return on Assets (ROA) and Return on Equity (ROE) declined—profits dropped, reflecting the strain across the sector MDPI.

2.3 Regulatory Interventions

To prevent a systemic collapse, the Bank of Uganda (BoU) deployed several support measures:

- Cut the Central Bank Rate by 250 basis points to 6.5 % since April 2020, lowering borrowing costs Monitor.

- Introduced emergency liquidity support (CLAP) and extended credit relief measures (crucially in education and hospitality sectors through September 2022) Monitor.

- Banned dividend payouts to preserve capital buffers MDPI.

These efforts cushioned the blow, preventing widespread bank failures.

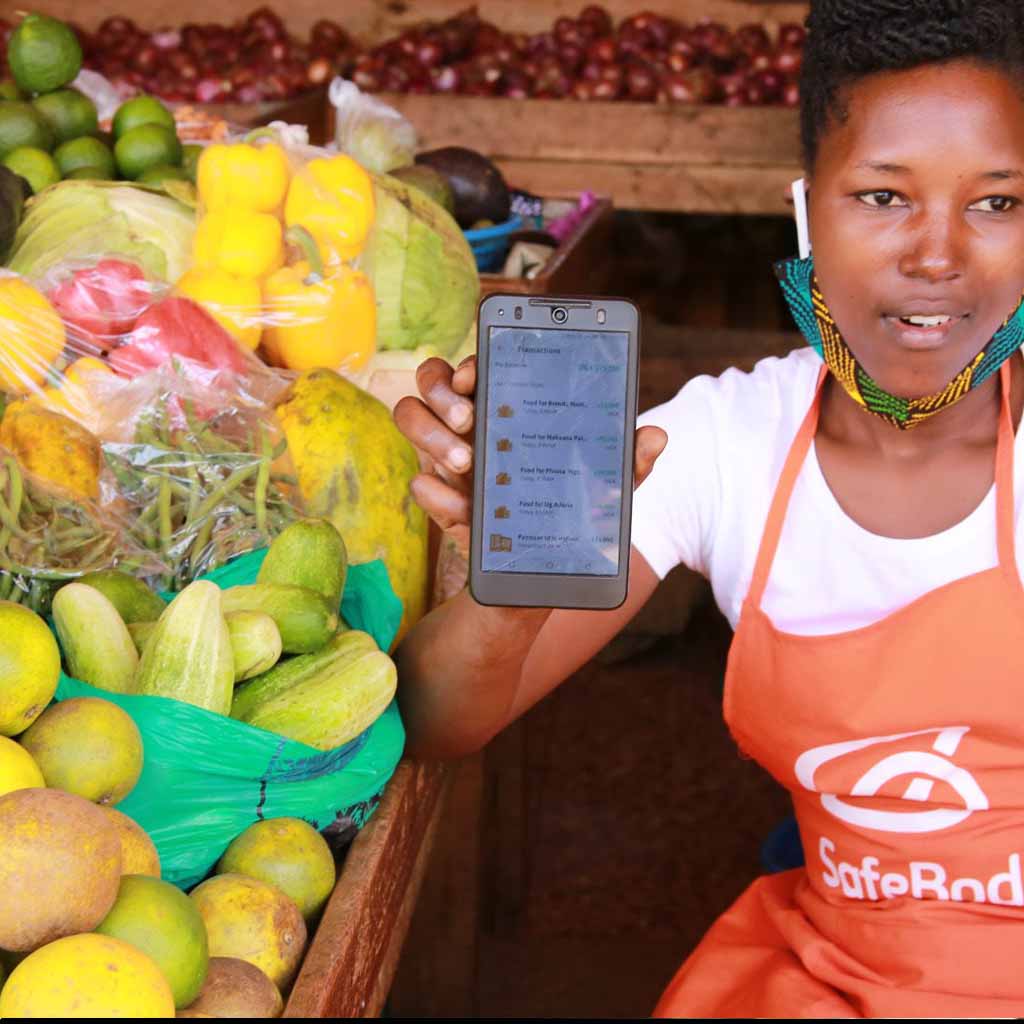

3. The Digital Boost: Adoption, Inclusion, and Risks

3.1 Surge in Digital Transactions

COVID‑19 triggered a sharp increase in digital banking adoption:

- Internet banking rose 30.2%, mobile banking 135.2%, and mobile money transactions 28.2% year‑on‑year by Dec 2020 Monitor.

- Active internet and mobile banking users grew by 36.7% and 46.9% respectively in mid‑2020 MDPI.

This shift both helped maintain financial activity and pushed inclusion forward.

3.2 Emerging Cyber Risks

However, this came with increased cyber vulnerabilities:

- Attacks peaked in 2021–2024, impacting Equity Bank, Stanbic, MTN MoMo and even BoU—highlighting serious security gaps UGStandard.

- In response, BoU issued tougher cybersecurity guidelines and required banks to strengthen ICT risk management ceo.co.ug.

3.3 Regulatory Foundations Strengthened

Progress had already been made under ongoing reforms:

- The National Financial Inclusion Strategy (NFIS II) (2023–2028) pushes for green finance, gender-inclusive products, and broader rural access IMF eLibrary+1.

- Regulatory frameworks like the NPS Act 2020, fintech licensing, and consumer protection have enhanced digital infrastructure resilience IMF eLibrary.

4. Recovery Momentum: Stabilization and Resilience

4.1 Capital and Liquidity Strength

By late 2024:

- Liquidity Coverage Ratio (LCR) stood at an impressive 349.5 %, well above the 100 % regulatory minimum Kyambadde’s story.

- NPL levels improved—NPL ratio dropped to 4.9% by September 2024 Kyambadde’s story.

This signals recovery in asset quality and resilient liquidity.

4.2 Payment Systems Scaling Up

Uganda’s payment infrastructure gained traction:

- RTGS (interbank transfers) processed UGX 808.7 trillion in the year to June 2024 ceo.co.ug.

- EFTs handled UGX 59.4 trillion, and cross-border systems like EAPS and REPSS grew significantly ceo.co.ug.

This expansion underpins smoother interbank and regional transfers.

4.3 MSMEs and Development Bank Support

MSMEs were hit hard during lockdowns, with over 60% reporting drops in sales and cashflow New Vision. In response:

- The Uganda Development Bank launched stimulus programs—SME Kazi loans, asset financing, long-term credit at 10–12 %, plus advisory support Nilepost News.

- These schemes aim to revive small businesses and sustain post‑pandemic growth.

4.4 Consumer Confidence Safeguarded

The Deposit Protection Fund (DPF), managing UGX 1.62 trillion as of mid‑2024, continued protecting deposits up to UGX 10 million—keeping trust high during uncertainty Wikipedia.

5. Persisting Challenges & Future Focus

5.1 Inequality in Financial Access

Despite gains, rural and female financial inclusion lags:

- Rural account ownership remains low; only 32% of rural adults have bank access (vs. 42% urban) IMF eLibrary.

- Deposit use among adult women (35.8%) notably trails men (71%) IMF eLibrary.

5.2 Cybersecurity Continues to Loom

The shift online continues—but so does cyber risk. Strengthened protocols and oversight remain vital UGStandardceo.co.ug.

5.3 MSME Vulnerability

Survival rates are low—70% of MSMEs fail before their second anniversary. Broadening access to patient, affordable finance remains urgent Nilepost News.

5.4 Persistent Credit Risk

While NPLs improved, economic pressures (like inflation or supply shocks) could derail credit recovery.

6. The Road Ahead: Recommendations & Vision

| Area | Recommendations |

|---|---|

| Digital Resilience | Continue bolstering cybersecurity; mandate multi-layer authentication, frequent audits. |

| Inclusion Focus | Scale agent networks to rural areas; develop women-focused credit products; expand green finance under NFIS II. |

| MSME Support | Expand UDB programs; introduce new hybrid financing (grants + loans); enhance business training. |

| Capital Adequacy | Preserve capital reserves; monitor sector stress indicators closely. |

| Payment Robustness | Extend RTGS/EAPS reach; maintain infrastructure uptime to avoid disruptions like internet shutdowns of 2021 Monitor. |

| Regulatory Evolution | Harmonize fintech regulation; encourage sandbox innovation; sustain reforms from NFIS II and NPS Act. |

7. Summary: Banking Recovery in Focus

- Initial shock: NPLs rose, profits dropped, but timely policy buffers shielded banks.

- Digital acceleration: Mobile/internet banking surged, though cyber threats expanded.

- Recovery phase: Capital buffers and liquidity stayed robust; payment networks and MSME financing expanded.

- Ongoing gaps: Rural and gender disparities, MSME fragility, and cybersecurity require continued attention.

Final Thoughts

Uganda’s banking sector has navigated the COVID‑19 crisis with remarkable strength. Swift central bank interventions, digital innovation, and expanding MS‑ME support steered recovery. Yet, the journey ahead demands persistent effort—building inclusive access, enhancing cyber defenses, and reinforcing MSME resilience will define the sector’s long-term strength and inclusivity.

Leave a Reply