A Comprehensive Guide to Home Financing Options and Requirements

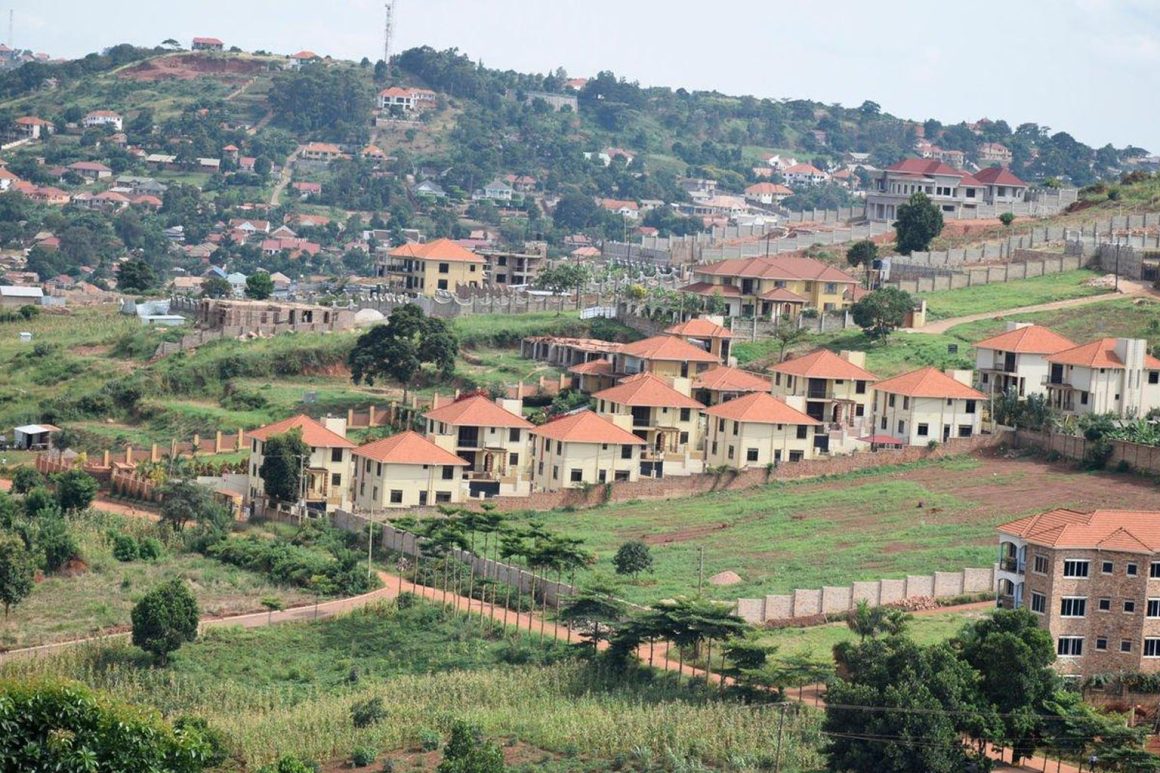

Homeownership remains one of the most significant milestones for individuals and families in Uganda. As urbanization accelerates and housing demand rises, mortgage financing is increasingly becoming the pathway to acquiring property, whether for residential, rental, or mixed-use purposes. While the mortgage market in Uganda is still developing, the growth of competitive loan products, more flexible repayment options, and the involvement of regulated institutions have made home ownership more achievable than ever before.

This in-depth guide covers the mortgage process in Uganda, types of home loans, how to qualify, and tips for navigating lenders and property markets.

1. What Is a Mortgage?

A mortgage is a long-term loan that allows you to purchase, construct, or renovate property, using the property itself as collateral. You repay the loan over a defined period (usually 5 to 20 years), including interest. If repayments are not made, the lender has legal rights to repossess and sell the property.

Mortgages in Uganda are typically issued in Uganda Shillings (UGX), though some banks offer USD-denominated options for clients with stable foreign income.

2. Common Types of Mortgages in Uganda

Different banks and financial institutions offer a variety of mortgage products based on your specific needs:

2.1. Home Purchase Mortgage

- Used to buy an already-built residential property

- Repayment periods: 5–20 years

- Requires property valuation and title transfer

2.2. Home Construction Loan

- Disbursed in stages as you build

- Requires approved building plans, a land title, and permits

- Often includes a post-construction conversion into a standard mortgage

2.3. Home Improvement/Renovation Loan

- For upgrading, repairing, or extending existing homes

- Shorter loan periods (2–10 years)

- Collateral usually required

2.4. Equity Release or Mortgage Refinance

- Unlocks capital from an existing property

- You receive a loan against the value of your home (minus existing loans)

- Useful for large personal projects or business capital

2.5. Buy-to-Let or Rental Mortgages

- For purchasing investment property to rent out

- Offered by select banks with higher equity or income thresholds

3. Top Mortgage Providers in Uganda

Most leading banks offer mortgage facilities, each with varying rates, fees, and terms. Key players include:

- Stanbic Bank Uganda

- Housing Finance Bank (Uganda’s leading mortgage lender)

- DFCU Bank

- Centenary Bank

- Absa Uganda

- Equity Bank Uganda

- PostBank Uganda

Note: As of recent market reviews, Housing Finance Bank controls a significant portion of the mortgage market, thanks to its long-term specialization and support from the Uganda Mortgage Refinance Company (UMRC).

4. Eligibility Criteria for a Mortgage

Though requirements vary by lender, the following are commonly assessed:

- Applicant must be at least 21 years old

- Must have stable income from employment, business, or rental

- Must be a Ugandan citizen or resident with legal identification

- Minimum monthly income (varies by bank, e.g. UGX 1M–3M net income)

- Clean credit history with the Credit Reference Bureau

- Proof of ability to provide a down payment or equity contribution

5. Required Documentation

To apply for a mortgage in Uganda, prepare the following:

- National ID/passport (and spouse’s ID if married)

- Three to six months’ salary or business income statements

- Employment letter or business registration documents

- Property offer letter or sale agreement

- Approved architectural plans (for construction loans)

- Recent bank statements

- Land title free of encumbrances

- Valuation report (by a bank-approved valuer)

- Proof of equity contribution/down payment

6. Interest Rates, Loan Terms & Charges

As of 2025, mortgage interest rates in Uganda range between:

- 14% – 18% per annum for UGX mortgages

- 8% – 12% for USD mortgages (for diaspora clients or USD earners)

Loan periods range from 5 to 20 years, with flexible options for early repayment or refinancing.

Additional charges may include:

- Loan processing fee (1% – 2% of loan amount)

- Legal fees (0.5% – 1%)

- Insurance: fire insurance and mortgage protection insurance

- Valuation fee (varies depending on property size and location)

- Stamp duty on transfer (usually 1% of property value)

Tip: Always request a full cost breakdown and repayment schedule from the bank before signing.

7. The Mortgage Process – Step by Step

- Pre-qualification: Consult the bank to assess your eligibility and borrowing capacity

- House hunting or construction planning: Identify a property or prepare plans

- Loan application: Submit your documents for credit analysis

- Property valuation and title verification by the bank

- Loan offer: If approved, you receive a letter of offer with detailed terms

- Signing of mortgage contract, property transfer, and registration

- Disbursement of funds (in lump sum or stages for construction loans)

- Repayment: Begin making monthly installments until the loan is cleared

8. How Much Can You Borrow?

Banks generally lend up to 70% – 90% of the property’s value, depending on:

- Loan product type (purchase, construction, etc.)

- Your income and ability to repay

- Value and location of property

- Amount of equity contribution you can provide

Example: If a property costs UGX 100 million and your bank offers 85% financing, you will need to raise UGX 15 million as a deposit.

9. Mortgage Tips for First-Time Buyers

- Start saving early for a deposit and fees

- Maintain consistent income and avoid new debt during application

- Choose a property with a clean title and good valuation

- Work with a trusted property agent or lawyer

- Ask the bank if you qualify for special schemes (e.g. salary earners, diaspora, civil servants)

10. Government Support & Affordable Housing

The Government of Uganda, through partnerships with organizations like Shelter Afrique, World Bank, and UN-Habitat, has rolled out initiatives to support affordable housing and long-term mortgage finance. Some notable developments:

- Uganda Mortgage Refinance Company (UMRC): Improves liquidity for mortgage lenders

- Public-private partnerships for affordable housing estates

- Tax incentives for developers building low-cost housing

- Integration of mortgage finance into the Parish Development Model (future potential)

11. Challenges in Uganda’s Mortgage Market

Despite progress, several barriers remain:

- Limited affordable housing stock

- High interest rates compared to other countries

- Complex land tenure and title verification processes

- Low financial literacy among first-time buyers

- Low penetration of long-term fixed-rate mortgage products

Efforts are ongoing by regulators, banks, and housing advocates to address these challenges and make mortgages more accessible.

12. Alternatives to Traditional Mortgages

If a formal mortgage is not viable, consider:

- Incremental building using savings or microloans

- SACCO or community-based housing funds

- Employer-sponsored housing programs

- Rental-to-own or joint property development models

Conclusion

Mortgages in Uganda are no longer just for the wealthy. With growing financial products, regulatory support, and housing initiatives, ordinary Ugandans now have a real opportunity to become homeowners. By understanding the process, planning your finances, and working with credible institutions, you can move one step closer to securing a place you can proudly call home.

Leave a Reply